This handbook is a summary of the defined benefit provision of the OMERS Primary Pension Plan (OMERS Plan). In this booklet, we refer to the OMERS Primary Pension Plan as the “OMERS Plan.”

The information in this booklet provides a summary of the terms of the OMERS Plan text at the time of publication. From time to time, the OMERS Plan text may be amended by the OMERS Sponsors Corporation. If there is any discrepancy between this information and the Ontario Municipal Employees Retirement System Act, 2006 (OMERS Act, 2006) and the OMERS Plan text, the OMERS Act, 2006 and OMERS Plan text will govern.

The OMERS Primary Pension Plan Registration Number is 0345983.

Providing OMERS with your personal information is considered consent for its use and disclosure for the purposes set out in our Privacy Statement, as amended from time to time. You can find out more about our collection, use, disclosure and retention of personal information by reviewing our Privacy Statement.

If you have questions about privacy at OMERS please contact OMERS Member Experience

The OMERS Plan is a defined benefit pension plan, which means you can expect a predictable monthly income for life. Together with government benefits and your savings, your OMERS pension can grow into an important financial asset and play a key role in your financial security in retirement.

If you’re a permanent, full-time employee who works at least 32 hours per week (also called continuous full-time ), you automatically become a member of the OMERS Plan on the date you are hired by an OMERS participating employer (OMERS employer), or on the date you become full-time. You remain a member even if you change from full-time to non-full-time.

You’re a non-full-time employee for OMERS Plan purposes if, for example, you work less than a full work week or you work fewer than 12 months a year.

For example, if you are a 10-month, contract or seasonal employee, you either:

join the OMERS Plan when you are hired (if it is your employer’s participation policy); or

choose to join the OMERS Plan when you become eligible.

Subject to your employer’s participation policy and prior to January 1, 2023, you become eligible and may choose to join if you meet one of the following conditions in both of the previous two calendar years with any OMERS employer:

you worked at least 700 hours; or

you earned at least 35% of the Canada Pension Plan (CPP) year's maximum pensionable earnings (YMPE).

Once you become a member, you remain in the OMERS Plan even if your work hours or income fall below the eligibility requirements, or if your work status changes to or from full-time.

Effective January 1, 2023, the eligibility rules for non-full-time employees described above no longer apply. This means that all non-full-time employees may elect to join the OMERS Plan following their hire date. As noted above, some employees may be required to join the OMERS Plan in accordance with their employer’s participation policy.

Enrolment in the OMERS Plan generally takes effect on the date of your employer’s next available pay period after your election is received. This date can be no later than the end of the month following the month in which the election is received.

Once you become a member, you remain in the OMERS Plan while you are employed with an OMERS employer even if your income decreases or your work status changes to or from full-time status.

Once you join the OMERS Plan, you are encouraged to create a myOMERS.com account. myOMERS is a secure portal where you’ll have access to your myOMERS dashboard, which includes a number of digital self-serve options to quickly and easily update your contact and beneficiary information, generate pension estimates and more. It’s easy to create an account. All you need is your OMERS seven-digit reference number from your welcome package, the last three digits of your social insurance number and your date of birth.

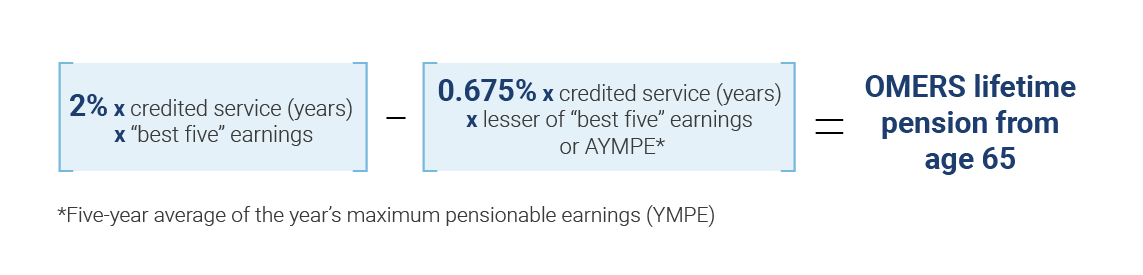

The more years of credited service you have in the OMERS Plan, the larger your pension benefit will be. The OMERS defined benefit pension formula takes into account your best five consecutive years of contributory earnings ("best five" earnings earnings) and credited service in the OMERS Plan.

The OMERS pension is paid to you after you retire for as long as you live.

If you retire before age 65, the bridge benefit supplements your OMERS pension until age 65, when it is expected that most members will start their CPP pension. The OMERS bridge benefit continues to be paid to age 65 even if you start your CPP pension before age 65. From age 65 onward, you continue to collect your lifetime pension.

An OMERS pension earned in excess of the maximum set by the Income Tax Act is paid through the OMERS retirement compensation arrangement (RCA), which is a special fund for this purpose.

See the Retirement section for more information about how your pension is calculated if you retire before your normal retirement age.

Your pension is “locked-in” as soon as you join the OMERS Plan, and you immediately begin to earn a pension and become entitled to a benefit. When your pension is “locked-in,” you must use it for future retirement income and you cannot cash out the value of your pension or your contributions, except in very specific cases allowed by applicable legislation and the OMERS Plan text.

In the OMERS Plan, there are two types of service.

This is the paid service (years and months) you have in the OMERS Plan, including any service you purchased or transferred in.

If you’re a continuous full-time employee, you earn one year of credited service for every full year you work. If you’re non-full-time, we calculate your credited service as a proportion of what a full-time employee in your position would earn. Also, when we calculate your pension as a non-full-time employee, we annualize your contributory earnings.

The maximum amount of credited service you can have depends on when you reach 35 years of credited service. Effective January 1, 2021, the 35-year cap for credited service was eliminated. This means that if you had less than 35 years of credited service prior to January 1, 2021, you can continue to accumulate credited service. If you met the 35-year cap on credited service prior to January 1, 2021, the limit on credited service will continue to apply to you.

For more information on the 35-year cap, including frequently asked questions, visit Frequently Asked Questions or contact OMERS Member Experience.

This is service with any OMERS employer that isn’t credited service and is subject to certain limits. It can help bring you closer to an unreduced early retirement pension; however, it does not change the credited service used in the OMERS pension formula. We add your eligible service to your credited service when we calculate your early retirement pension factor (discussed further in the Retirement section).

summer-student work with an OMERS employer where you did not participate in the OMERS Plan;

service from a prior membership period in the OMERS Plan that was transferred or refunded when you left employment with an OMERS employer;

unpurchased leaves taken in accordance with applicable employment standards legislation while employed with an OMERS employer (for example, pregnancy/parental leaves); and

unpurchased waiting periods to join the OMERS Plan.

You may be able to purchase some eligible service and convert it to credited service. See the “ Retire with a Bigger OMERS Pension” section.

Have you worked for an OMERS employer, but you were not in the pension plan?

Check myOMERS and make sure that period of employment is included with your eligible service. If it isn’t, contact OMERS Member Experience

You will contribute a percentage of your contributory earnings in each pay period to the OMERS Plan. Your OMERS employer will also contribute an equal amount. These contributions will fund a portion of your OMERS pension. Investment earnings of the OMERS Fund will contribute the balance.

To keep the OMERS Plan adequately funded, the OMERS Sponsors Corporation periodically adjusts contribution rates. Your contributions to the OMERS Plan lower your taxable income at source. Amounts you contribute to buy a leave period or past service may also lower your taxable income for the applicable tax year(s).

Required contributions are lower on contributory earnings up to the Canada Pension Plan (CPP) year's maximum pensionable earnings (YMPE) and higher on any salary above the YMPE. This is determined on a per pay period basis.

If you leave your employer, begin collecting your OMERS pension or die before your pension starts, a test is applied to ensure that your contributions on or after January 1, 1987 do not exceed 50% of the commuted value (CV) of your pension over the same period. Any excess contributions will be refunded to you, your beneficiary or your estate, as applicable.

See the your contributions section for more information about contributions.

Participating in a defined benefit pension like the OMERS Plan is a tax-efficient form of saving. Under the Income Tax Act, you are eligible for certain tax advantages as a result of your participation in the OMERS Plan, as summarized below:

You contribute a percentage of your earnings to help pay for your future OMERS pension.

Your employer deducts these contributions from your gross income each pay period, which reduces your taxable income at source. As a result, over the course of the year, the income on which you pay taxes has been reduced by the amount of your pension contributions. This will be reflected on your annual T4 tax slip.

Contributing to the OMERS Plan is similar to contributing to a Registered Retirement Savings Plan (RRSP). One of the differences is that your tax liability is reduced right away, so that you don’t have to wait until you file your tax return to benefit.

Your employer also contributes an equal amount to the OMERS Plan. These contributions are not a taxable benefit; you do not count them as income.

Once you retire and begin collecting your OMERS pension, your pension will be taxable and withholding taxes will be deducted from your payments. In many cases, the annual tax liability associated with a member’s pension payments will be lower than that of the member’s earnings while employed.

Note that all payments from the OMERS Plan are payable in accordance with the Income Tax Act and cash payments are subject to applicable taxes withholding at source.

While you’re working, you pay OMERS Plan contributions on your regular and recurring “contributory” earnings in each pay period, excluding additional amounts such as overtime pay and also excluding most one-time payments and lump-sum payments. When you end membership in the OMERS Plan, these same contributory earnings are used to calculate your pension benefit (i.e., the “best five” earnings in the OMERS pension formula).

There are two caps on contributory earnings:

Post-2010 contributory earnings are capped at:

150% x your contributory earnings before Incentive pay

Total annual contributory earnings are limited to seven times the YMPE effective:

January 1, 2014 for members who enrolled in the OMERS Plan on or after January 1, 2014; and

January 1, 2016 for members who enrolled or re-enrolled in the OMERS Plan before January 1, 2014.

Inflation protection increases OMERS retirement, disability and survivor pensions each year, based on the increase in the Canadian Consumer Price Index (CPI), as follows:

Benefits earned on or before December 31, 2022 receive full inflation protection, up to a maximum increase of 6%. Any excess is carried forward so it can be used in later years when the CPI increase is less than 6%.

Benefits earned on or after January 1, 2023 are subject to Shared Risk Indexing, meaning that the level of inflation protection will depend on the OMERS Sponsors Corporation Board’s annual assessment of the financial health of the OMERS Plan.

See the inflation protection section to learn more about inflation protection.

When you are a member of the OMERS Plan, a pension adjustment (PA) must be reported on your T4 tax slip each year and will reduce your available RRSP contribution room. The PA is a deemed value of the pension you earned in a tax year. The Canada Revenue Agency (CRA) uses the PA from the previous year to calculate your new RRSP contribution room for the current year.

The OMERS Plan has a disability waiver benefit and a disability pension.

While on a disability waiver (also called “disability waiver of contributions”), you continue to accumulate credited service in the OMERS Plan as if you are still working based on your contributory earnings at the time your disability leave started.

The OMERS Plan covers the contributions you and your employer would have made if you were not on a disability leave. Your contributory earnings at the time your leave started are used to calculate your pension and are increased by the lower of the annual increase in the Average Industrial Wage (AIW) or the CPI.

To qualify for a disability waiver you must be totally disabled as defined by the OMERS Plan.

The disability waiver begins on the later of:

the first day of the fifth month after you become totally disabled; or

the day after you cease to make regular contributions based on 100% of your contributory earnings prior to your leave.

The disability waiver benefit continues until the earliest of the following events occurs:

you are no longer totally disabled;

you begin receiving an OMERS disability or early retirement pension (the latter is only available if you terminate employment with your OMERS employer);

you return to work with your OMERS employer or another employer (other than on an OMERS-approved rehabilitation program);

you terminate employment with your OMERS employer prior to your early retirement birthday (55th birthday if you have a normal retirement age of 65 or 50th birthday if you have a normal retirement age of 60) and elect to transfer your benefit from the OMERS Plan; or

you reach your normal retirement date.

If you become totally and permanently disabled as defined by the OMERS Plan, you can begin a disability pension. Your disability pension is an unreduced pension calculated using the OMERS pension formula.

You can find the formula in the “How your pension grows” section.

The maximum OMERS disability pension that you can receive is 85% of your monthly contributory earnings that you last received from your OMERS employer.

If you are in receipt of Workplace Safety and Insurance Board (WSIB) benefits, this amount will also be counted towards the maximum disability pension you can receive. In this case, your combined monthly WSIB benefit and disability pension from the OMERS Plan cannot exceed 85% of the monthly contributory earnings that you last received from your employer.

If you exceed these limits, your OMERS disability pension will be reduced until you reach your normal retirement age. If you are in receipt of WSIB benefits and the WSIB benefit changes before your normal retirement date (for reasons other than inflation adjustments), you are required to contact OMERS with the updated amount. The disability pension can begin on the later of:

the first day of the fifth month after you become totally and permanently disabled; or

the first of the month following the month you elect a disability pension, if you have been on a disability waiver.

If you are on a disability waiver immediately before beginning an OMERS disability pension, the waiver benefit ends when your pension begins, and you will no longer accrue credited service in the OMERS Plan.

The disability pension continues until the earliest of the following events occurs:

you no longer meet the definition of totally and permanently disabled;

you return to work with your OMERS employer or another employer (other than on an OMERS-approved rehabilitation program);

you begin an early retirement pension (this is only available if you terminate employment with your OMERS employer); or

you reach your normal retirement date, and your disability pension becomes an OMERS normal retirement pension.

Members must provide all relevant medical and other information to be eligible to continue to receive disability benefits and advise OMERS of changes in their eligibility.

If, because of an illness or other condition, your life expectancy is less than two years, you may be able to withdraw the CV of your pension plus any refund of contributions you may be eligible for in cash, less applicable tax withholding. Once you receive this shortened life expectancy benefit, no further benefit is payable from the OMERS Plan to you, your survivors, beneficiary or estate. If you have an eligible spouse, they must provide their written declaration consenting to you withdrawing the funds using the required OMERS form.

Benefit calculation changes that took effect on January 1, 2013 affect you if your employment ends and you are not yet eligible for an early retirement pension. That is, if you have not reached your early retirement birthday (55th birthday for normal retirement age (NRA) 65, or 50th birthday for normal retirement age 60), your benefit will be calculated in two parts:

The benefit based on pre-2013 credited service includes pre-retirement indexing (inflation protection) and early retirement subsidies (including the OMERS bridge benefit).

The benefit based on post-2012 credited service does not include pre-retirement indexing or early retirement subsidies.

These changes apply only if you leave your OMERS employer before your early retirement birthday.

Pre-retirement indexing is the inflation protection we apply to your benefit from the date you leave your OMERS employer to the date your pension begins. The pre-2013 portion of your benefit will include inflation protection, whether you leave your benefit in the OMERS Plan or transfer the commuted value out. The post-2012 portion of your benefit will not include pre-retirement inflation protection.

Early retirement subsidies affect your benefit calculation for service earned after 2012 and the amount of the OMERS bridge benefit.

As of January 1, 2013, your benefit will be calculated in two portions: pre-2013 and post-2012.

your early retirement pension will be reduced by 5% per year that you’re short of the 90 Factor or 85 Factor, 30 years of service or your normal retirement age (this is the “subsidized” reduction).

The OMERS bridge benefit will be included in the pre-2013 portion.

This portion no longer includes a possible unreduced early retirement pension. When you eventually begin your pension, the post-2012 portion will be reduced on an actuarial-equivalent basis (an “unsubsidized” reduction).

If your normal retirement age is 65, the OMERS bridge benefit will not be included in the post-2012 portion.

If your normal retirement age is 60, a five-year portion of the bridge benefit (from age 60 to 65) will be included in the post-2012 portion.

See the “ Retirement ” section for more information.

Generally, if you take a leave of absence that has been authorized by your OMERS employer, you may buy the service for the time you are away in order to have it treated as credited service. This includes both leaves protected by employment standards legislation (for example, pregnancy, parental, family medical and personal emergency leaves) and other leaves authorized by your employer. The cost of contributing towards or buying the service depends on the type of leave and how long ago the leave was taken.

For more information on purchasing a leave, including the cost and purchase deadline, visit omers.com or contact OMERS Member Experience.

Depending on your age and the amount of your pension, options when you leave your OMERS employer could include:

Keeping your pension with OMERS gives you a future stream of retirement income for life.

If you go to work for another OMERS employer, you may be able to combine your entire pension record under a single membership with your new OMERS employer.

On or after your early retirement birthday, you can elect to start receiving your OMERS pension.

If you go to work for a non-OMERS employer, you may be able to transfer your OMERS pension into your new employer’s defined benefit registered pension plan (RPP).

You are eligible to transfer the CV of your pension if you leave an OMERS employer and you have not yet reached your early retirement birthday. This is a time-limited option.

If you decide to transfer your CV, you have six months to do so. If you rejoin the OMERS Plan after making this transfer, you have to wait five years from when you transferred out your CV before you can buy back the associated service.

If the annual pension you’ve earned is less than 4% of the YMPE, you may be eligible for a cash refund (or a tax-deferred transfer to your RRSP) of the CV of your OMERS Plan benefit.

Effective July 1, 2012, as permitted by law, OMERS elected to be excluded from providing “grow-in” provisions for certain terminating members.

If you file a grievance/legal proceeding for termination of employment with the intention of being reinstated, the CV option (#5 above) is still available. If you are reinstated, you may repay the benefit to OMERS to re-establish your benefit.

On or after your early retirement birthday (55th birthday for members with a normal retirement age of 65 or 50th birthday for members with a normal retirement age of 60), you are eligible for retirement options once you leave employment — you can retire and begin your OMERS pension — but the CV option (#5 above) is no longer available.

If you leave your OMERS employer before your early retirement birthday, the CV option is available for a limited period and, starting in 2013, certain benefit calculation changes will affect your benefit.

See the “ Benefit calculation changes” section for more details.

Your normal retirement date is the end of the month in which you turn:

age 65 if your normal retirement age (NRA) is 65 (NRA 65); or

age 60 if your normal retirement age is 60 (NRA 60).

If you continue to work with an OMERS employer, you can continue to contribute to the OMERS Plan and earn credited service past your normal retirement date. However, the Income Tax Act requires that your OMERS pension must begin on December 1st of the year in which you reach age 71, whether or not you are still working, and you will no longer make contributions.

If you have terminated employment with an OMERS employer and have a pension you have not transferred from the OMERS Plan, you must start your monthly pension payments as of your normal retirement date.

OMERS pension payments begin the first of the month following the month you retire. For example, if your last day of employment with your OMERS employer is March 10th, the earliest date that you can start your OMERS pension is the first business day of April. Monthly pensions are not pro-rated.

Members are encouraged to reach out to their OMERS employer or Member Experience to get more information when they are thinking about retiring.

If you have terminated employment with your OMERS employer, you can elect and begin to receive an early retirement pension on or after your early retirement birthday (55th birthday if you have a normal retirement age of 65 or 50th birthday if you have a normal retirement age of 60). If you elect to start receiving an early retirement pension from the OMERS Plan after you stop working with an OMERS employer, your early retirement date will be the last day of the month immediately prior to your pension starting. As noted above, all pension payments from the OMERS Plan start on the first business day of the month. There are two types of early retirement pensions: unreduced and reduced.

An unreduced early retirement pension is calculated without a reduction. You qualify for an unreduced early retirement pension if you have:

30 years or more of service*; or

the “90 Factor” if your normal retirement age is 65 or the “85 Factor” if your normal retirement age is 60.

The 90 Factor is: your age + service* = 90 or more The 85 Factor is: your age + service* = 85 or more

*eligible service + credited service

Reduced early retirement pension If you don’t qualify for an unreduced pension, you can still retire but your pension will be reduced by a 5% reduction factor as follows. The reduction factor is pro-rated for part years. If your normal retirement age is 65, your OMERS pension is reduced by 5% per year multiplied by the least of:

65 minus your age when you retire;

90 Factor minus your current age-plus-service* factor; or

30 years minus your years of service*.

If your normal retirement age is 60, your OMERS Plan pension is reduced by 5% per year multiplied by the least of:

60 minus your age when you retire;

85 Factor minus your current age-plus-service* factor; or

30 years minus your years of service*.

If you go back to work for an OMERS employer in a position where you are eligible to enrol in the OMERS Plan, you will either be re-enrolled in the OMERS Plan or offered enrolment on a voluntary basis (depending on the position) unless:

it is past November 30th of the year you turn age 71; or

you specifically elect to continue receiving your pension and not re-enrol.

Subject to these exceptions, if you re-enrol in the OMERS Plan, your pension will stop and you will resume as a continuing member.

When you subsequently retire, all of your credited service and earnings are combined and your pension is recalculated.

For more information on life in retirement, including returning to work with an OMERS employer, visit Frequently Asked Questions or contact OMERS Member Experience

In the event of a member’s separation and/or divorce, OMERS must administer any valuation and/or division of OMERS Plan benefits in accordance with the Ontario Pension Benefits Act and applicable family law.

More information on the rules is available on the Separation and divorce section or on the Ontario pension regulator’s website at www.fsrao.ca

OMERS Plan survivor benefits are paid according to a set order of entitlement that complies with the Ontario Pension Benefits Act. This order cannot be changed, for example, by a will.

See the Glossary for the applicable spousal definitions (pre-retirement spouse, retirement-date spouse and post-retirement-date spouse) and note the requirement that your spouse cannot be “living separate and apart” from you at the relevant date. The Glossary also includes the definition of eligible dependent children.

If you die before retirement, the order of entitlement to survivor benefits is as follows:

Spouse – Your pre-retirement spouse can choose a survivor pension or cash refund/transfer.

Children – If there is no pre-retirement spouse, a children’s pension (see below) will be paid to any eligible dependent child (ren) for as long as they are eligible.

Designated beneficiary – If there is no pre-retirement spouse or eligible dependent child(ren), your designated beneficiary (ies) on file may be entitled to a cash refund.

Estate – If there is no pre-retirement spouse, eligible dependent child(ren) or designated beneficiary (ies), a cash refund may be paid to your estate.

See the “Explanation of survivor benefits” section below for details on the survivor pension, children’s pension, cash refund and residual refund.

In addition to the OMERS Plan survivor benefits, the following refunds may be payable in the event of death before retirement.

If you leave your OMERS employer, start your OMERS pension or die before your pension starts, a test is applied to ensure that your contributions on or after January 1, 1987 do not exceed 50% of the CV of your pension over the same period. Any excess contributions will be refunded to you, your beneficiary or, if none, to your estate.

If you do not have a spouse eligible for a survivor pension at the time of your death and the CV of your OMERS pension is greater than the amount needed to fund the survivor benefit for your eligible dependent child(ren) (if any), the difference is paid as an OMERS Plan special refund. It is paid to your living designated beneficiaries on file or, if none, to your estate.

If you die after retirement, the order of entitlement to survivor benefits is as follows:

Spouse – Your retirement-date spouse (or post-retirement-date spouse if there is no eligible retirement-date spouse) will receive a survivor pension.

Children – If there is no retirement-date spouse or post-retirement-date spouse, a children’s pension will be paid to any eligible dependent child(ren) for as long as they are eligible.

Designated beneficiary – If there is no retirement-date spouse, post-retirement-date spouse or eligible dependent child(ren), your designated beneficiary(ies) on file may be entitled to a residual refund.

Estate – If there is no retirement-date spouse, post-retirement -date spouse, eligible dependent child(ren) or designated beneficiaries, any residual refund may be paid to your estate.

An OMERS Plan survivor pension equals:

66 2/3% of your lifetime pension*

plus a further 10% for each eligible dependent child, up to a total of 100% of the pension you earned.

The survivor pension is guaranteed for your eligible spouse’s life (it does not stop if your spouse remarries) and is eligible for OMERS inflation protection increases (see “Inflation protection” section). It does not include the OMERS bridge benefit.

If there is no eligible spouse, an OMERS children’s pension equals:

66 2 /3% of your lifetime pension*; or

the survivor’s pension the spouse was receiving at their date of death (less any entitlement for eligible children).

A children’s pension is divided equally among the eligible children and is paid to, or on behalf of, each child. When a child is no longer eligible, the benefit is redistributed among the remaining eligible children. It is eligible for OMERS inflation protection increases (see “Inflation protection” section), and it does not include the OMERS Plan bridge benefit.

In the case of a surviving child being a minor, benefits of $35,000 (on a gross basis) or less can be paid to the adult who has custody of the child; benefits over $35,000 are subject to Guardianship of Property rules.

*For death before retirement, this is 66 2/3% of the monthly lifetime pension you earned to the date of death or to the date you left your OMERS employer. For death after retirement, this is 66 2/3% of the monthly lifetime pension you were receiving at the date of death.

The cash is paid in a lump-sum and equals:

the CV of the pension you earned since January 1, 1987; plus

any contributions you made before 1987, plus interest to the date of your death.

Applicable taxes are deducted immediately. If payable to an eligible spouse, that individual can transfer the cash refund to a non-locked-in registered retirement savings arrangement.

The residual refund is the total of your OMERS Plan contributions plus interest, minus any pension paid to you and/or your survivors.

Note After about five years of retirement, most members have received pension payments equal to their contributions plus interest, so there may not be a residual refund.

In the event a benefit is payable to a designated beneficiary (in accordance with the order of entitlement explained above), OMERS can only administer the benefit if the OMERS Plan member has validly named a beneficiary or beneficiaries. An executor, estate trustee, power of attorney for property or survivor cannot name or change your designated beneficiary(ies).

It is important to note that eligible spouses already have priority to survivor benefits. If an OMERS Plan member chooses to also name their spouse as a designated beneficiary, that designation does not change in the event of a separation or divorce.

It is very important that members review the information they have on file with OMERS from time to time (including their contact and beneficiary designation information) and keep it updated to reflect their communication and designation preferences.

You can update your beneficiary information quickly and easily online. Visit myOMERS today to get started.

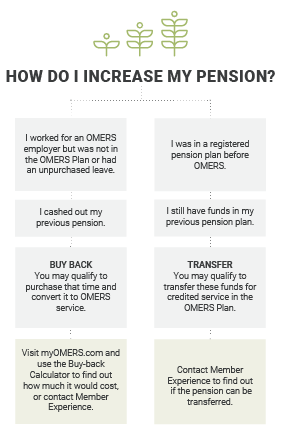

If you belonged to another registered pension plan, you worked for an OMERS employer but were not in the OMERS Plan, you had an unpurchased leave or you transferred/cashed out your OMERS pension, you may be able to transfer or buy back that service and convert it to credited service in the OMERS Plan. This will increase your OMERS pension and may allow you to retire earlier without a reduction.

Subject to applicable legislation, OMERS can accept transfers into the OMERS Plan from most Canadian public- and private-sector registered pension plans, which may enable you to bring your pension from your previous employer into the OMERS Plan.

Contact OMERS Member Experience to find out if your pension can be transferred.

Types of service you can buy back to increase your credited service in the OMERS Plan include:

Refunded/transferred service after 1991 (including a waiting period) with another registered pension plan.

Leaves with an OMERS employer that you didn’t purchase before the purchase deadline (for example, a pregnancy or parental leave that ended more than two years ago).

Eligible service with an OMERS employer – including a post-1991 waiting period to join the OMERS Plan, or previously refunded service.

A shortfall in transferred service – when the amount you transferred into the OMERS Plan from another registered pension plan didn’t buy the same amount of credited service in the OMERS Plan.

If you rejoin the OMERS Plan after transferring the CV of your pension out of the OMERS Plan, you will have to wait five years from when you transferred your CV before you can buy back the associated service.

If you rejoin the OMERS Plan after transferring the commuted value (CV) of your pension out of the OMERS Plan, you will have to wait five years from when you transferred your CV before you can buy back the associated service.

If you think you have service that you can buy back, contact OMERS Member Experience to see if it’s purchasable.

OMERS offers Additional Voluntary Contributions (AVCs), which can increase your savings. Similar to RRSPs in some ways, AVCs are administered as part of the OMERS Plan but separate from your OMERS defined benefit pension.

Funds in an AVC account are invested in the globally diverse OMERS Fund, earn the OMERS Fund Net Rate of Return and are subject to an administrative fee. AVCs are also subject to the AVC Terms of Participation (available on omers.com).

There are two ways to contribute to an AVC account:

Transfer funds from a registered retirement savings vehicle, for example, an RRSP.

Automatic contributions by pre-authorized debit or payroll deduction through your employer*, from as low as $40 a month or $20 biweekly (active members only).

Everyone has their own unique retirement goals and AVCs could help you reach yours.

Note

The additional voluntary contribution provision is part of the OMERS Plan and is subject to the conditions established by the OMERS Administration Corporation pursuant to Section 47 of the OMERS Plan. The OMERS Plan and such related conditions may be amended in the future in accordance with the OMERS Act, 2006 and the Pension Benefits Act (Ontario). *Some OMERS employers offer payroll deductions for AVCs.

When you leave your employer, you start your OMERS pension, or if you die before your pension starts, a test is applied to ensure that your contributions on or after January 1, 1987 do not exceed 50% of the commuted value (CV) of your pension over the same period. Any excess contributions will be refunded to you, your beneficiary, or your estate, as applicable.

The five-year average of the year’s maximum pensionable earnings (YMPE) determined at the time of a benefit calculation.

The annual average of the 60 consecutive months during which your contributory earnings were at their highest. It does not include any overtime pay or most lump-sum payments. It may, however, include earnings from a period of service that was transferred in from another registered pension plan. If you have less than five years of credited service, we use your contributory earnings over your entire period of credited service to calculate your average earnings.

Buying back previous service that is eligible for a buy-back converts it to credited service in the OMERS Plan. The previous service could be service with an OMERS employer that currently doesn’t count as credited service or refunded service with another pension plan.

The maximum amount of earnings used to calculate contributions and pensions under the Canada Pension Plan (CPP). Also called the year’s maximum pensionable earnings (YMPE).

OMERS considers a common-law spouse to be a person who is not married to the member but living together with the member in a conjugal relationship:

continuously, for a period of not less than three years; or

in a relationship of some permanence, if they are the parents of a child as set out in section 4 of the Children’s Law Reform Act. To be eligible for spousal survivor benefits, a common-law spouse cannot be “living separate and apart” (see definition below) from the OMERS Plan member at the relevant time.

The commuted value is the estimated amount of money you would have to put aside today, to grow with tax-sheltered investment earnings, to provide you with a future benefit similar to the OMERS pension you’ve earned at the relevant time.

You are a continuous full-time member if you are a permanent, full-time employee who is regularly scheduled to work over the full calendar year and works at least 32 hours a week.

Your early retirement birthday is the day you reach:

age 55 if your normal retirement age is 65; or

age 50 if your normal retirement age is 60

OMERS considers an eligible child to be:

a natural child;

a legally adopted child; or

a person whom you have demonstrated a settled intention to treat as a child of your family (except under an arrangement where the child is placed for valuable consideration in a foster home by a person having lawful custody).

At the time of your death, the eligible child must be dependent on you for support and also must be:

18 years or younger in the year of your death;

under age 25 and a full-time student; or

totally disabled (see definition of “Totally disabled child”).

OMERS considers a legal spouse to be a person who is legally married to the member. To be eligible for spousal survivor benefits, a legal spouse cannot be “living separate and apart” (see definition below) from the OMERS Plan member at the relevant time.

Whether two persons are “living separate and apart” is often complicated to assess. It is a question of both fact and law, and must be determined on a case-by-case basis. OMERS uses a number of factors to make this determination in accordance with applicable statutory and common law requirements. In general, physical separation is usually, but not always, an indication that two persons are living separate and apart. However, physical separation is not always conclusive. There must also be a mutual or unilateral intention for two persons to live separate and apart and end the marriage or common-law relationship. For example, a physical separation between two spouses caused by one of them living in a nursing home will not necessarily result in a determination that the spouses are living separate and apart, provided that both spouses intended the marriage or common-law relationship to continue despite the physical barrier

When your pension is “locked-in,” you must use it for future retirement income. You cannot cash it out, except in very specific cases allowed by applicable legislation and the OMERS Plan text. The pension benefits you accrue are immediately locked in when you join the OMERS Plan.

Non-full-time members may include members who work less than a full-time work week or less than a full calendar year. They can be short-term, casual, temporary, seasonal, student, part-time, 10-month or contract employees.

Most members in the OMERS Plan have a normal retirement age of 65. Many police and firefighters, including firefighters or police who become employed by a participating police or fire association, have a normal retirement age of 60 (NRA 60). Effective January 1, 2021, an employer will have the option to provide normal retirement age 60 (NRA 60) benefits to all or a class of paramedics. For unionized employees, NRA 60 benefits are subject to negotiation between employers and unions

Your normal retirement date is the end of the month in which you reach your normal retirement age.

The OMERS Fund rate of return less investment management expenses.

If you enter into a spousal relationship after retirement, and there is no person who qualifies as your retirement-date spouse (see definition), OMERS considers the surviving legal spouse or common-law spouse at the date of your death to be the eligible spouse for the purpose of spousal survivor benefits, provided you were not “living separate and apart” (see definition) on the date of your death and the rights to survivor benefits have not been waived

A portion of your OMERS pension with respect to service after 1991 may be paid by the OMERS retirement compensation arrangement (RCA) if your earnings exceed the amount that generates the maximum pension allowed by the Income Tax Act (ITA). This determination is made when you terminate employment or retire. The RCA is a trust arrangement separate from the Primary Plan, and is not governed by the Pension Benefits Act nor is it a Registered Pension Plan under the ITA. The RCA is governed by the OMERS Act, the ITA and other applicable legislation. It is funded on a partial pay-as-you-go basis by equal contributions from participating employers and active members and by the investment earnings of the RCA fund.

Total contributions OMERS receives are allocated between the Primary Plan Fund and the RCA Fund in accordance with the Allocation Threshold, which is the level of contributory earnings below which your related contributions are directed to the Primary Plan Fund and above which they are directed to the RCA Fund. The Allocation Threshold is set each year by the OMERS Sponsors Corporation, based on calculations by the OMERS external actuary. More details about the Allocation Threshold are available in the funding policy for RCA (available on omers.com).

OMERS annually determines contributions to target sufficient funding. The target aims to ensure that the RCA fund, future contributions, and future investment earnings are sufficient to pay projected benefits and expenses over a 20-year period.